Navigating the landscape of property ownership in Ghaziabad—one of the key cities in the National Capital Region (NCR)—comes with a set of responsibilities, chief among them being the timely payment of Ghaziabad property tax. This essential municipal levy is the backbone of local development, funding everything from improved civic amenities and infrastructure projects like core mall studio apartment to public sanitation services managed by the Ghaziabad Nagar Nigam (GNN).

For property buyers, investors, and existing homeowners, understanding the nuances of how Ghaziabad property tax is calculated, the payment process, and the available benefits is not just about compliance; it’s about smart financial planning and ensuring the legal security of your real estate investment. This detailed guide breaks down everything you need to know, offering a clear, professional, and practical perspective.

Unpacking the Basics of Ghaziabad Property Tax

The property tax in Ghaziabad is a direct tax levied by the Ghaziabad Municipal Corporation (GMC) or Nagar Nigam Ghaziabad (NNG) on all real estate within its jurisdiction. This includes both residential and commercial properties, as well as vacant land plots. The revenue generated is crucial for maintaining and enhancing the city’s civic infrastructure.

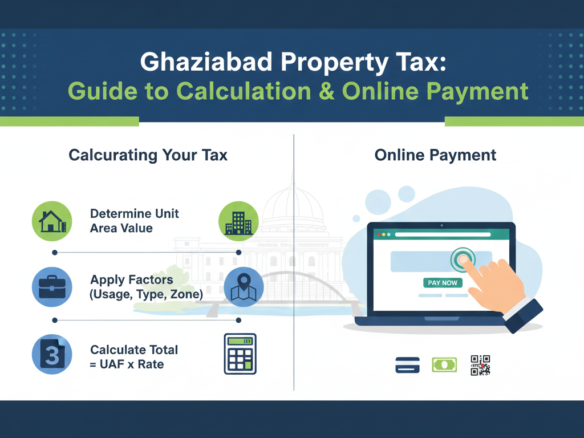

The Unit Area Value System

Ghaziabad uses the Unit Area Value (UAV) system to determine the property tax amount. Unlike systems based purely on market value, the UAV method assigns a ‘unit value’ per square foot or square metre of the built-up area. This unit value is then adjusted based on several key factors, ensuring a more equitable and systematic assessment across the city.

The primary determinants of your annual Ghaziabad property tax liability include:

-

- Location/Zone of the Property: Ghaziabad is often divided into categories (like A, B, and C) based on the prevalent rental values and development status. Category ‘A’ areas, being more affluent and developed, have higher unit values than ‘C’ areas.

-

- Built-up/Covered Area: The total area of construction, including parking spaces, is a direct multiplier in the calculation.

-

- Property Usage: Tax rates differ significantly for residential, commercial, and industrial properties, with commercial spaces typically attracting a higher tax rate due to their income-generating potential.

- Age and Construction Quality: Older properties or those with ‘kutcha’ construction may receive some reduction compared to new ‘pucca’ structures.

🧮 How to Calculate Your Ghaziabad Property Tax

While the Nagar Nigam Ghaziabad (NNG) provides a simplified online mechanism for payment and assessment, understanding the underlying formula offers greater clarity. The calculation is based on the annual rateable value of the property, which is essentially the gross annual rent the property is expected to fetch.

The general framework for calculating Ghaziabad property tax is based on the following formula, which adheres to the Uttar Pradesh Municipal Corporation Rules, 2000:

1. Calculate Gross Unit Area Value (G):

2. Calculate Reduction Amount (I):

3. Determine Net Unit Area Value (J):

4. Final Property Tax (K):

-

- The property tax is typically assessed as 20% of the Net Unit Area Value post-reduction.

This detailed formula highlights the importance of the property’s specific dimensions, usage, and location in determining the final payable amount. For an accurate and hassle-free assessment, property owners are encouraged to use the self-assessment system available on the official GNN website.

💻 Step-by-Step Guide to Online Payment

The Ghaziabad Nagar Nigam (GNN) has made the process of paying your Ghaziabad property tax simple, secure, and accessible through its online portal. This digital shift promotes transparency and saves property owners considerable time and effort.

The Online Payment Process

-

- Visit the Official Portal: Navigate to the official website of the Ghaziabad Nagar Nigam for tax payments.

-

- Locate Your Property: Click on the ‘Pay Tax Online’ or a similar option. You will usually be asked to search for your property details using one of the following identifiers:

-

- PIN NO (Property Identification Number): A unique 15-digit number found on your previous tax bill.

-

- Owner’s Name

-

- House Number

-

- Latest Receipt Number

-

- Locate Your Property: Click on the ‘Pay Tax Online’ or a similar option. You will usually be asked to search for your property details using one of the following identifiers:

-

- Select Your Zone: Choose the correct municipal zone (e.g., City Zone, Kavi Nagar, Mohan Nagar, Vasundhara, or Vijay Nagar) where your property is situated.

-

- Verify Details: Once the search is complete, the portal will display your property’s details—including the owner’s name, address, previous tax history, and the current amount due (House Tax, Water Tax, Sewerage Tax, and any arrears). Always cross-verify all details carefully.

-

- Proceed to Payment: Click on ‘Pay Tax’ or ‘Proceed to Pay’. You may have an option to update your mobile number.

-

- Select Payment Mode: Choose your preferred payment gateway:

-

- Net Banking

-

- Debit/Credit Card

-

- UPI

-

- For offline payment, you may also have the option to generate an e-Challan.

-

- Select Payment Mode: Choose your preferred payment gateway:

-

- Complete Transaction: Finalize the payment. Upon successful completion, a digital receipt or e-Challan will be generated.

-

- Save the Receipt: It is crucial to download and print the payment receipt for your records. This serves as your legal proof of timely payment of your Ghaziabad property tax.

💰 Property Tax Rebates and Penalties

The Ghaziabad Municipal Corporation often introduces incentives to encourage timely payment, typically in the form of rebates for early tax payments, and applies penalties for defaults.

Rebate System (Subject to Annual Notification)

To motivate property owners to clear their dues at the beginning of the financial year, the GMC usually announces a tiered rebate structure. While the exact dates and percentages can change annually, a common structure observed is:

-

- Higher Rebate (e.g., 20%): Offered for payments made in the first few months of the financial year (e.g., till June or July).

-

- Reduced Rebate (e.g., 10%): Applicable for payments made in the subsequent months (e.g., August-September).

-

- Minimal Rebate (e.g., 5%): For payments made towards the end of the rebate period (e.g., December-January).

Actionable Tip: Always check the official GMC notifications at the start of the new financial year to maximize your savings through these early bird rebates.

Consequences of Default

Failure to pay your Ghaziabad property tax by the stipulated deadline can lead to several complications:

-

- Penalty/Interest: Delayed payments are subjected to a monthly interest or penalty on the outstanding amount, significantly increasing your total liability.

-

- Legal Action: In severe cases of persistent non-payment, the municipal corporation has the authority to initiate legal proceedings, which can include the attachment or auction of the property to recover the dues.

-

- Disruption of Services: Defaults may also lead to the disconnection of essential municipal services like water or sewerage.

📝 Key Documents and Special Circumstances

To ensure a smooth and accurate tax process, property owners should maintain a ready file of necessary documents.

Essential Documents for Property Tax Compliance

-

- Previous Property Tax Receipt: Crucial for verifying past payments and outstanding arrears.

-

- Property ID/PIN Number: The unique identifier for your property.

-

- Sale Deed/Title Deed: Proof of legal ownership.

-

- Aadhaar Card/PAN Card: Valid government-issued ID for identity and address verification.

-

- Building Plan Approval: Required, especially for new constructions or recent mutations.

Property Mutation in Ghaziabad

Property mutation—the process of updating ownership records in municipal documents—is critical after a sale, inheritance, or gift. Only once the mutation is complete and the property is legally transferred in municipal records will the tax demand switch to the new owner’s name. The property tax receipt is a mandatory document for the mutation process.

Real Estate Investment and Ghaziabad Property Tax

For investors and business owners, understanding the tax structure is part of due diligence. Ghaziabad’s continuous growth, driven by key infrastructure projects like the Delhi-Meerut Expressway (NH9) and the expansion of the Metro network, makes property here a compelling investment.

-

- Commercial Property Taxes: Given the higher tax slab for commercial properties, investors must factor in this greater operating cost when calculating their Return on Investment (ROI) and rental yields.

-

- Vacant Plot Tax: Even vacant plots within the GMC limits are subject to tax based on their capital value. This cost must be considered when holding land for future development.

A well-managed property, with all its taxes including the Ghaziabad property tax paid up-to-date, maintains a clear title and commands a better market value, making it a more liquid asset.

❓ Frequently Asked Questions (FAQs) about Ghaziabad Property Tax

Navigating municipal taxes often leads to common questions. Here are the answers to some of the most frequent queries property owners have regarding their Ghaziabad property tax.

1. What is the deadline for paying Ghaziabad property tax?

The general deadline for property tax payment in Ghaziabad is typically March 31st of the financial year. However, it is highly recommended to pay early to avail of the rebates usually offered in the first few months (April to July/September). Always confirm the exact dates on the official Ghaziabad Nagar Nigam website.

2. How can I get my PIN NO if I don’t have an old property tax bill?

If you do not have your Property Identification Number (PIN) or a previous bill, you can still search for your property details on the official GNN tax portal (onlinegnn.com) using your Name, House Number, and Mohalla (locality) name. If this fails, you should visit your respective Zonal Office of the Ghaziabad Nagar Nigam to update your details and obtain the PIN.

3. Is the property tax rate the same for residential and commercial properties in Ghaziabad?

No, the property tax rate is not the same. Commercial and industrial properties generally have a higher tax rate than residential properties in Ghaziabad. The tax is calculated differently based on the property’s use, with commercial properties being placed in higher unit area value categories due to their income-generating nature.

4. What happens if there is an unauthorized construction on my property?

Unauthorised construction can lead to severe penalties. The Ghaziabad Municipal Corporation can re-assess your property based on the increased covered area, leading to a higher tax liability, and may even impose fines or issue demolition orders. Always ensure your construction aligns with the approved building plan to avoid complications with your Ghaziabad property tax assessment and other legal issues.

5. Can I pay my Ghaziabad property tax offline?

Yes, you can pay your property tax offline. You can visit the nearest Nagar Nigam Ghaziabad Zonal Office or the designated collection counters to pay via cash, cheque, or Demand Draft. The official GNN website also allows you to generate an e-Challan which can be used for bank transfers or cash payment at authorized banks.

✅ Conclusion: Ensuring Compliance and Smart Investment

The payment of Ghaziabad property tax is a fundamental responsibility of every property owner in the city. By utilizing the convenient online payment system, understanding the Unit Area Value calculation method, and staying informed about the annual rebate schemes, you can ensure timely compliance and save money. A fully compliant property, with all tax dues cleared, not only contributes to the city’s progress but also remains a secure and valuable asset in Ghaziabad’s thriving real estate market.

The Core mall (Studio Apartments) Crossing Republic Ghaziabad

Ghaziabad, Uttar Pradesh, India- Bed: 1

- Bath: 1

- 474 sqft

- Studio

Core Mall Retail shop Crossing Republic Ghaziabad

NH-24, Sushant Aquapolis, Plot CC1, opposite Crossing Republic, Crossings Republik, Ghaziabad, Uttar Pradesh 201016- Bed: 1

- Bath: 1

- 200 sqft

- Shop

The Core Mall Food Court Crossing Republic Ghaziabad

NH-24, Sushant Aquapolis, Plot CC1, opposite Crossing Republic, Crossings Republik, Ghaziabad, Uttar Pradesh 201016- Bed: 1

- Bath: 1

- 196 Sqft

- Commercial

Core Mall Studio Apartments Crossing Republic Ghaziabad

NH-24, Sushant Aquapolis, Plot CC1, opposite Crossing Republic, Crossings Republik, Ghaziabad, Uttar Pradesh 201016- Bed: 1

- Bath: 1

- 473 sqft

- Studio

Join The Discussion