The dynamic landscape of the National Capital Region (NCR) makes every real estate decision a complex financial puzzle, particularly for young professionals and investors looking for an entry point. As 2026 approaches, a crucial question dominates the minds of those eyeing this flourishing city: Should I rent or should I buy a Noida studio apartment? This decision is far more than a simple matter of monthly expense; it is a long-term wealth strategy. Noida, with its rapid infrastructure growth, robust connectivity, and burgeoning IT and commercial hubs like the area surrounding Cyber Arch IT Park, presents unique market conditions.

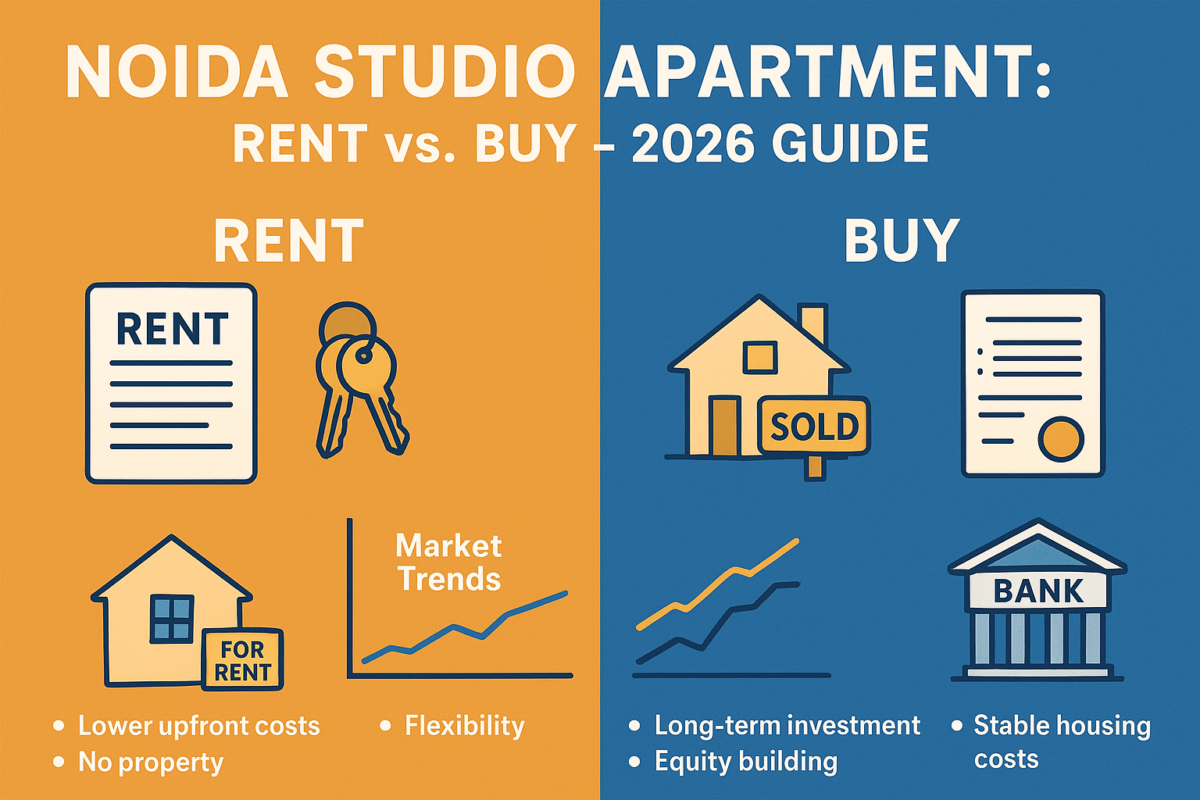

The traditional wisdom of “always buy” is increasingly being challenged by the flexibility and lower initial costs associated with renting. However, a Noida studio apartment—given its compact size, lower entry price, and high rental yield potential—often defies conventional comparison models. This ultimate 2026 financial analysis will cut through the noise to provide a clear, data-driven comparison of renting versus buying. We will analyze the total cost of ownership, monthly cash flows, long-term asset appreciation, and the often-overlooked tax implications for a Noida studio apartment. Our goal is to equip you with the deep insights necessary to make the most informed, strategically sound decision for your financial future in Noida.

Understanding Noida Studio Apartment Dynamics in 2026

The term Noida studio apartment refers to a single room dwelling that combines the living, dining, and sleeping areas into one open space, with a separate bathroom. Crucially, in Noida, many studio apartments are part of mixed-use or commercial projects, attracting a different buyer profile than traditional residential units. This distinction is vital when comparing the financial implications of a Noida studio apartment rent vs. buy scenario. The smaller size inherently means a lower total purchase price, making ownership accessible to first-time buyers or smaller investors who might be priced out of 2BHK or 3BHK segments. Furthermore, the high concentration of working professionals near business districts like the various sectors along the Noida Expressway and the region around Cyber Arch IT Park ensures a steady, high demand for rentals, which drives up potential rental yield for investors who choose to buy a Noida studio apartment.

- Key Demographic: Primarily single professionals, young couples, and students.

- Property Type: Often categorized as commercial or serviced apartments, impacting financing and tax structures.

- Financial Advantage: The lower capital outlay is the primary factor tilting the Noida studio apartment decision towards buying for many.

The Core Financial Battle: Noida Studio Apartment EMI vs Rent Comparison

The decision between renting and buying a Noida studio apartment boils down to a head-to-head comparison of two primary monthly outflows: the monthly rent and the Equated Monthly Instalment (EMI). In 2026, the current market trend shows that for a typical studio unit, the EMI is often higher than the prevailing rent, especially in newly developed sectors.

| Financial Component | Renting a Noida Studio Apartment | Buying a Noida Studio Apartment |

| Upfront Cost | Low (1-3 months’ security deposit + 1 month’s rent) | High (15-20% Down Payment + Stamp Duty + Registration) |

| Monthly Outflow | Rent (subject to annual increase) | EMI (Fixed for the loan tenure) + Maintenance + Property Tax |

| Long-Term Value | Zero Asset Creation | Equity Building + Capital Appreciation |

For a studio apartment priced at an average of ₹40 lakhs, the initial deposit for buying could be ₹8-10 lakhs, plus additional charges. Renting, on the other hand, might only require ₹50,000 to ₹75,000 upfront. While the monthly rent might be ₹15,000, the EMI for a 20-year loan at 9% interest could hover around ₹30,000-₹35,000. This immediate cash flow discrepancy is the first hurdle in the Noida studio apartment rent vs. buy debate. However, the EMI builds equity, while rent is a sunk cost, which must be factored into the long-term analysis.

Initial Capital Outlay: The Biggest Barrier to Buying a Noida Studio Apartment

The substantial upfront cost is often the single most prohibitive factor preventing a professional from buying a Noida studio apartment. Beyond the down payment, which can strain savings, the buyer must account for stamp duty, registration fees, GST (for under-construction properties), legal fees, and home insurance. These costs can collectively add another 5-10% to the purchase price.

- Example Scenario: A ₹40 lakh Noida studio apartment.

- Buying Upfront Cost: Down Payment (₹8L) + Stamp Duty/Reg (₹2.4L) + Other Fees (₹1.6L) = ₹12 Lakhs

- Renting Upfront Cost: Security Deposit (₹30K) + First Month Rent (₹15K) = ₹45,000

Renting a Noida studio apartment provides immediate financial liquidity. This saved capital can be invested in higher-yielding avenues like Systematic Investment Plans (SIPs) or stocks, generating returns that could potentially offset the loss of property appreciation. This concept forms the core of the financial comparison, transforming the simple Noida studio apartment rent vs. buy choice into a comparative investment strategy.

Long-Term Returns on Noida Studio Apartment Investment: Capital Appreciation & Rental Yield

When assessing the long-term financial value, buying a Noida studio apartment shines due to two main factors: capital appreciation and high rental yield. Noida’s real estate market, fueled by major projects like the Jewar Airport and the expansion of the metro network, is projected to see steady capital appreciation of 6-8% annually over the next decade.

The rental yield—the annual rental income as a percentage of the property value—is exceptionally high for studio apartments in Noida, often ranging between 4% and 7%, significantly higher than the 2-3% typical for larger residential units. The high demand from young, mobile professionals working at offices near hubs like the Cyber Arch IT Park makes studio apartments a cash-flow positive investment, providing a long-term return on investment (ROI). This dual benefit of asset growth and consistent cash flow is the strongest argument in favor of the ‘buy’ decision for a Noida studio apartment.

Tax Benefits of Buying a Studio Apartment in Noida: Maximizing Fiscal Advantages

A crucial, often-underestimated factor in the Noida studio apartment rent vs. buy calculation is the array of tax benefits available to homeowners. These fiscal advantages can significantly reduce the effective monthly cost of owning the property, making the EMI vs. Rent gap much narrower.

- Section 80C: Principal repayment of the home loan is deductible up to ₹1.5 lakhs per year.

- Section 24(b): Interest paid on the home loan is deductible up to ₹2 lakhs per year for a self-occupied property. For a rented-out Noida studio apartment, the entire interest paid can be set off against the rental income.

- HRA Exemption (for Renting): While a renter can claim House Rent Allowance (HRA) exemption, the tax savings are usually smaller and less permanent compared to the deductions available to a homeowner.

For a borrower in the highest tax bracket, these deductions can translate to tens of thousands of rupees in annual savings, effectively lowering the cost of owning the Noida studio apartment and making the purchase a more viable financial choice than renting.

Lifestyle and Flexibility: Renting a Noida Studio Apartment for Mobility

While the financial arguments often favor buying for the long term, the lifestyle benefits of renting a Noida studio apartment are undeniable, especially for the typical target demographic. Renting offers unparalleled flexibility—a major advantage for young professionals whose career paths might demand relocation to a different city or even a different part of Noida, perhaps closer to a new opportunity further from the Cyber Arch IT Park area.

- Zero Transaction Cost: Moving out involves little more than giving notice and getting the security deposit back, avoiding the significant time and cost of selling a property.

- No Maintenance Headache: The landlord is responsible for all major and minor repairs, freeing the renter from the unexpected costs and time commitment of property upkeep.

- Try Before You Buy: Renting allows one to test out a neighborhood or community before committing to a long-term purchase, ensuring the chosen Noida studio apartment is in the ideal locale.

The financial cost of this flexibility is the lost opportunity for wealth creation through asset appreciation. The decision here is a clear trade-off: Stability and Wealth Creation (Buy) vs. Mobility and Low Responsibility (Rent).

Market Trends Around Noida Studio Apartment Demand: Post-2025 Growth

The Noida real estate market is undergoing a structural shift driven by new infrastructure and a post-pandemic preference for compact, efficient housing. The development of major expressways and the proximity to the upcoming Jewar International Airport have positioned Noida as a prime investment destination. Studio apartments, in particular, are seeing a surge in demand as corporate sectors expand their presence.

- Proximity to IT Hubs: Areas near the Noida Expressway, including the sectors bordering the Cyber Arch IT Park, have a massive influx of single working professionals, creating a robust, high-demand rental market for the Noida studio apartment.

- Affordability Factor: With residential property prices rising, studio apartments remain the most affordable route to property ownership in a Tier-1 NCR city, keeping the entry barrier low for investors.

- Commercial Potential: Many studio apartments in Noida are part of commercial complexes, sometimes offering guaranteed rental returns or easier leasing to corporate tenants, which adds an extra layer of financial security for buyers.

This sustained high demand ensures that both the capital value and the rental income from a Noida studio apartment are likely to appreciate well into 2026 and beyond.

The Break-Even Horizon: When Buying a Noida Studio Apartment Becomes Cheaper

The “break-even horizon” is the point in time when the cumulative cost of buying a Noida studio apartment (including down payment, EMI, maintenance, and transaction costs) becomes less than the cumulative cost of renting (rent, security deposit, and annual rent increases). For a typical studio apartment in Noida, considering current interest rates and an annual rent increase of 5%, this break-even point is often reached within 7 to 10 years.

- Pre-Break-Even: Renting is financially cheaper due to lower upfront and monthly costs.

- Post-Break-Even: Buying becomes financially superior due to equity accrual, tax benefits, and cessation of the annual rent-hike expense.

Therefore, the anticipated duration of stay in Noida is the most significant determinant of the Noida studio apartment rent vs. buy decision. If you expect to stay for less than seven years, renting offers greater financial prudence and flexibility. If you plan to settle down for a decade or more, buying the Noida studio apartment is the clear winner for long-term wealth creation.

Investment Considerations: Buying a Noida Studio Apartment for Rental Income

For a pure investor, buying a Noida studio apartment specifically for rental income presents a compelling case. The high rental yield combined with moderate appreciation potential offers a strong total return profile. The key is to select a studio apartment in a location with proven tenant demand, such as near a metro station or a major employment hub like Cyber Arch IT Park.

- Higher Yield: As noted, studio apartments typically generate a higher percentage yield than larger flats.

- Lower Vacancy Risk: The affordability and desirable location of a well-chosen Noida studio apartment ensure high occupancy rates.

- Management Ease: Due to their compact nature, studio apartments are generally easier to manage and maintain for a remote investor.

The choice to buy a Noida studio apartment as an investment vehicle is a strategy focused on cash flow and asset diversification, making the initial higher monthly cost a necessary step toward passive income generation.

Why You Should Choose the Best Financial Path for Your Noida Studio Apartment Goals

The final choice between renting and buying a Noida studio apartment is a deeply personal one, combining financial capacity with future lifestyle goals. The 2026 financial analysis clearly shows that renting provides immediate savings, unparalleled flexibility, and freedom from property-related responsibilities. It’s the perfect choice for the young professional or student with an uncertain job location or a short-term plan in the city.

In contrast, buying a Noida studio apartment is a path to creating a tangible asset, building equity, providing a hedge against inflation, and unlocking significant tax benefits. It’s the superior long-term financial strategy for anyone planning to be in Noida for a decade or more, especially if the location is strategic and close to a thriving commercial district like Cyber Arch IT Park. Choose the option that aligns not just with your current salary, but with your five and ten-year personal and financial vision.

Conclusion

The dilemma of Noida studio apartment rent vs. buy in 2026 requires a nuanced, individual-centric financial evaluation, moving beyond simple cost comparisons. We’ve established that while renting a Noida studio apartment offers immediate financial relief, maximum flexibility, and zero maintenance stress—making it ideal for short-term stays (under seven years)—it ultimately results in zero wealth accumulation. Conversely, buying a Noida studio apartment, despite the high upfront costs and potentially higher initial monthly EMI compared to rent, is the undeniable choice for long-term financial security. The combined power of high rental yields, sustained capital appreciation in a thriving city like Noida, and significant tax advantages creates an asset that actively builds wealth. The best financial move for your Noida studio apartment is the one that best supports your timeline, stability, and long-term vision. Analyze your income, project your stay, and take the confident step toward securing your financial future in Noida.

Join The Discussion